For sure sentences in Florida and Virginia, you might be bought to submit a similar type called an FR-44. This needs a higher degree of responsibility coverage than the state's minimum. Not all states need an SR-22 or FR-44. If you require one, you'll learn from your state department of car or website traffic court.

When you're informed you need an SR-22, start by calling your car insurance business. Some insurers do not supply this service, so you may need to purchase a company that does (bureau of motor vehicles). If you do not currently have auto insurance, you'll probably require to acquire a policy in order to get your driving advantages restored.

Just how much greater depends upon where you live as well as what offense caused your SR-22. Insurance coverage quotes will certainly also differ depending on what car insurer you pick. To obtain the best price for you, it is necessary to compare rates from multiple insurance companies (credit score). See what you could save money on vehicle insurance policy, Easily contrast tailored prices to see exactly how much changing automobile insurance could save you.

Location matters. As an instance, take into consideration a driver with a recent DUI, an offense that might cause an SR-22 demand. Nerd, Wallet's 2021 price evaluation located that out of the nation's four biggest business that all submit an SR-22, insurance policy rates on standard were most affordable from Progressive for 40-year-old drivers with a recent drunk driving.

The Greatest Guide To Sr22 Insurance

In the majority of states, an SR-22 demand lasts 3 years. If your policy lapses while you have an SR-22, your insurance firm is needed to notify the state and your certificate will be put on hold. When your requirement ends, the SR-22 does not immediately diminish your insurance coverage. Ensure to allow your insurance provider know you no more need it.

no-fault insurance vehicle insurance ignition interlock car insurance insurance coverage

no-fault insurance vehicle insurance ignition interlock car insurance insurance coverage

Rates generally remain high for 3 to five years after you have actually triggered a crash or had a relocating violation. coverage. If you go shopping about following the three- and five-year marks, you may discover lower costs.

If you have an SR-22 filing in California and also want the lowest rates, it's finest to contrast a minimum of 3 different car insurer to ensure you obtain the finest feasible deal. SR-22 insurance coverage includes a loading expense, usually an one-time charge of around $25. You'll no more be qualified for any type of good vehicle driver discounts, making SR-22 insurance policy much more costly (sr22 insurance).

The golden state drivers searching for insurance after a ticket or crash need to shop around to find reduced prices however won't see the same high costs as those that need to obtain an SR-22. How long you require SR-22 insurance policy in The golden state depends on your conviction, but it is 3 years.

What Is Sr-22 Insurance Quotes? Can Be Fun For Everyone

Just how Do You Get SR-22 Insurance Policy in California? Your insurance coverage firm will certainly file an SR-22 form with the state upon your request.

Compare Car Insurance Policy Rates, Ensure you're getting the very best price for your vehicle insurance. Contrast quotes from the leading insurance policy companies. Non-Owner SR-22 Insurance Policy in California, Drivers in The golden state with significant traffic infractions and also a suspended license may have to submit an SR-22 and also purchase vehicle insurance to obtain their license renewed.

Normal auto insurance can be expensive for those that do not own a car, which is why non-owner cars and truck insurance coverage is the most effective choice for these sorts of vehicle drivers. This enables them to reveal evidence of liability insurance policy coverage to get their permit reinstated and guarantees their defense in case of another crash.

Frequently Asked Questions Regarding SR-22 Insurance Coverage in California, Drivers trying to find SR-22 insurance coverage in The golden state usually have questions regarding rates, the declaring procedure as well as that to patronize. Here are the solution to some of these usual inquiries. EXPAND ALLWhat is an SR-22 in The golden state? An SR-22 kind is required for The golden state drivers who have actually committed a major driving infraction, such as a DRUNK DRIVING.

The Facts About Sr-22 & Insurance: What Is An Sr-22? - Progressive Revealed

Rather, it's an additional kind that insurers file with the state on your behalf. Exactly how do I obtain an SR-22 certification in California? Insurance providers are required to file an SR-22 type on your part electronically if one is needed. In some situations, insurance policy companies might choose to no longer cover you if you require an SR-22.

Exactly how a lot does SR-22 insurance policy cost contrasted to a conventional plan in The golden state? SR-22 insurance coverage is quite a bit a lot more costly than a regular insurance plan in California. Cars and truck insurance sets you back approximately $1,857 annually for SR-22 coverage due to a DUI as well as an average of just $643 without an SR-22 type.

The same case puts on those that do not own a car. vehicle insurance. Non-owner cars and truck insurance coverage is the perfect choice for those who do not possess a car considering that typical car insurance can be costly. That suggests that such people will be covered in the occasion of an additional crash, and also they can likewise show evidence of obligation insurance protection to get their permit reinstated.

The reason why non-owner SR-22 insurance policy is less expensive is that the insurance firm thinks that you do not drive commonly, and also the only insurance coverage you obtain, in this situation, is for responsibility only. If you lease or obtain vehicles often, you need to think about non-owner vehicle insurance policy as well (coverage). Although rates can differ across insurance providers, the ordinary yearly expense for non-owner vehicle insurance policy in California stands at $932.

The 30-Second Trick For Jacksonville Sr-22 Insurance - Suspended Driver's License

Needs for An SR-22 in California First, recognize that an SR-22 affects your cars and truck insurance policy expense and also coverage. After a DUI sentence in California, standard vehicle drivers pay an average of 166% more than auto protection for SR-22 insurance. The minimum duration for having an SR-22 in The golden state is 3 years, however one may require it longer than that, relying on their situation and offense.

In any of these scenarios, an SR-26 type can be submitted by your insurance company - deductibles. When that occurs, your insurance provider needs to suggest that you no more have insurance protection with the entity. Beginning the SR-22 process over once again will certainly be required if your company files an SR-26 before finishing your SR-22 demand.

MIS-Insurance offers cheap SR22 insurance policy that will save you cash over the life of your policy - sr22. Cost effective SR22 insurance is offered and also we will certainly can help you protect the right plan for you.

insurance companies auto insurance department of motor vehicles dui sr22 coverage

insurance companies auto insurance department of motor vehicles dui sr22 coverage

A drunk driving will immediately boost your prices without thinking about extra price rises as well as refute you price cuts even if you were formerly receiving an excellent motorist price cut. As an example, rather of paying $100 monthly for cars and truck insurance policy, a chauffeur without DUI background will just pay $80 month-to-month, many thanks to the 20% good vehicle driver price cut they get.

3 Simple Techniques For Sr22 Insurance: What Is An Sr-22 And How Does It Work?

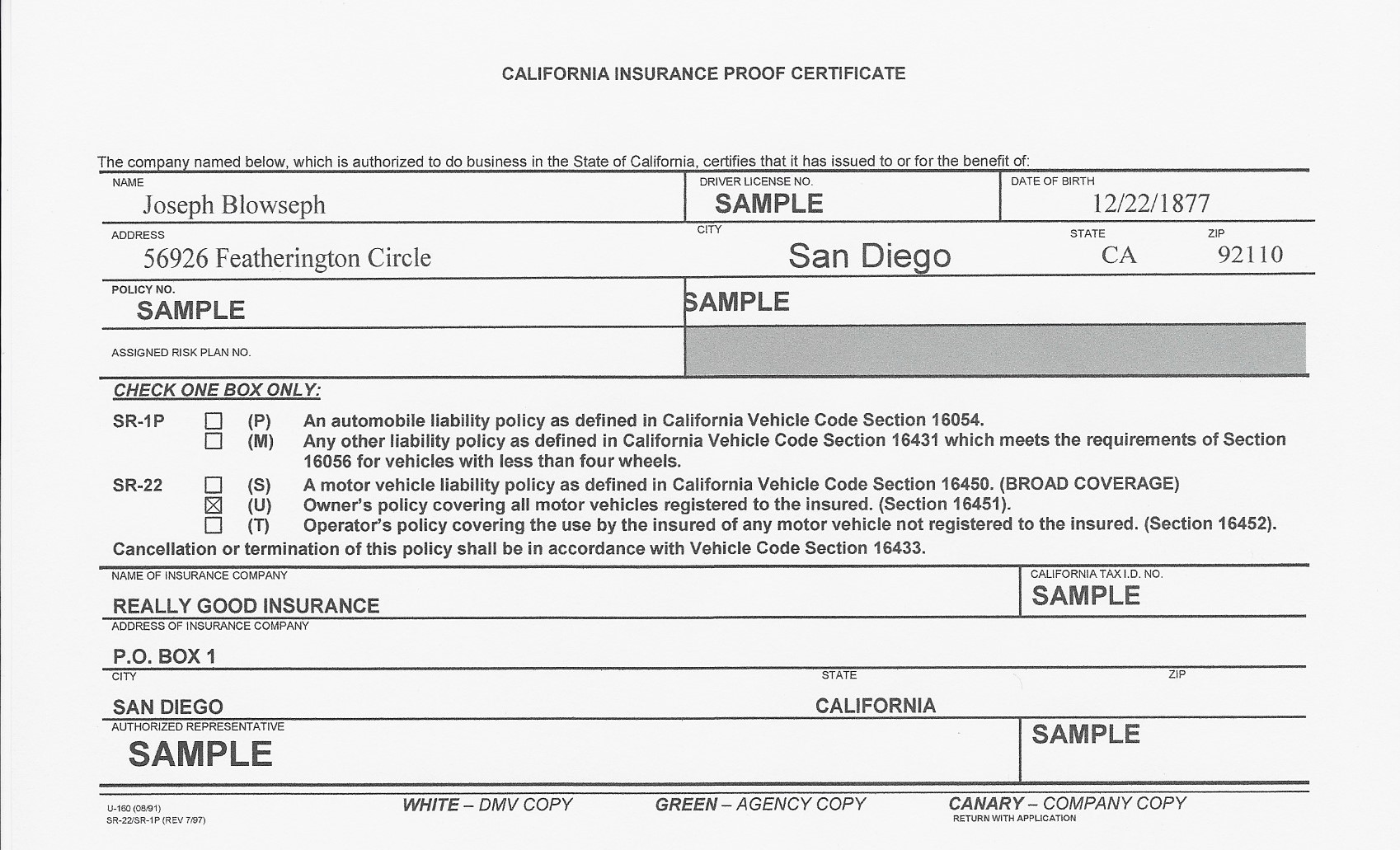

What you need to learn about SR-22 Declaring in The golden state When it concerns issues relating to vehicle insurance policy, our driving records, and also legal rights and also opportunities, in some cases we are educated things that merely are not real. Let's check out a few of the most typical misconceptions and misunderstandings pertaining to the SR-22 California: What is the SR-22 Driver Declaring? An SR-22 is a certificate of insurance filed by your insurance provider directly to the Department of Electric Motor Autos.

SR-22 Minimum Liability Purview The minimum liability restrictions should fulfill your state's demands. All you have to do is request your insurance coverage business to file an SR-22 for you, then the insurance firm takes care of the remainder - insure.

Avoid Future SR-22 Cancellations and Suspensions Once you have your SR-22 protection, you intend to ensure it does not obtain terminated or put on hold. auto insurance. You can do this by renewing it early. It has to be restored a minimum of 15 days prior to it runs out to see to it it isn't cancelled. The earlier you renew it, the more secure you'll be and the much less most likely your SR-22 will be cancelled.

You need to pay $55,000. 00 in safety and securities with the state treasurer! When Is an SR-22 Needed? Not all states call for an SR-22, but the ones that do may need them for any of the complying with factors: Dissatisfied Judgments Major Convictions Permit Suspensions Continue reading No Insurance Violations No Insurance Policy At The Time Of The Crash The Golden State SR-22 Filing Cost-U-Less can aid you submit an SR-22 in The golden state and we can additionally assist you acquire low-priced SR-22 insurance policy.

How Financial Responsibility Insurance Certificate (Sr-22) can Save You Time, Stress, and Money.

Filing charges are rather reduced, chauffeurs that need SR-22 insurance policy will certainly locate that their prices are more costly due to the DUI or various other violation that led to the SR-22 need in the first place. Just how much does SR-22 cost in California? SR-22 insurance coverage in California will cost more than what you formerly paid for automobile insurance coverage, but this is mainly because of the infraction that triggered you to require an SR-22 declaring.

Whether or not your present insurance provider will submit an SR-22 for you, one of the most basic ways to make sure you're obtaining one of the most affordable SR-22 insurance coverage is to compare quotes from multiple companies. Several major insurance firms in The golden state, including Progressive as well as Geico, will certainly file SR-22 kinds. bureau of motor vehicles. Considering that every insurer assesses your driving background according to its own standards, we advise contrasting at the very least three quotes to guarantee you're getting the best rates.

A chauffeur with no-DUI background paying $100 per month for automobile insurance may obtain a 20% excellent driver price cut and also only pay $80 per month. After getting a DUI, the chauffeur will certainly be back to paying a minimum of $100 monthly, which is 25% greater than the previous price cut rate.

Keep in mind that the SR-22 insurance coverage policy requires to list all cars you have or regularly drive. Just how long do you need to have an SR-22? The length of time you'll need to maintain SR-22 depends on your sentence, which ought to mention how much time you're anticipated to preserve the SR-22 declaring. credit score.

The 25-Second Trick For Financial Responsibility > Insurance Requirements/sr-22

driver's license insurance companies bureau of motor vehicles sr22 coverage insure

driver's license insurance companies bureau of motor vehicles sr22 coverage insure

Keeping continuous insurance coverage is essential. Any lapses in your SR-22 auto insurance will certainly cause your driving opportunities to be put on hold once again, as your insurance provider would submit an SR-26 type with the DMV informing them of the lapse. If you vacate California throughout your required filing duration, you'll need to locate an insurance firm that does business in both states as well as wants to submit the type for you in the state.

Throughout the one decade following a DUI, you won't be eligible for an excellent motorist discount in California. After this duration has actually run out, the drunk driving will certainly be eliminated from your driving document as well as you will be qualified for the discount again (insurance coverage). You may be able to obtain the conviction eliminated from your document previously, yet as long as you stick with the very same insurance company, the company will certainly find out about the drunk driving and also remain to use it when determining your SR-22 insurance rates.

credit score no-fault insurance vehicle insurance insurance companies insurance group

credit score no-fault insurance vehicle insurance insurance companies insurance group

It offers protection if you sometimes drive various other people's cars with their permission. For those that do not possess a vehicle, non-owner SR-22 insurance is a plan that provides the state-required obligation insurance however is connected to you as the driver, no issue which automobile you use. liability insurance. One of the advantages of non-owner SR-22 insurance is that quotes are commonly more affordable than for an owner's plan, since you'll only receive obligation protection and the insurance company assumes you drive much less regularly.